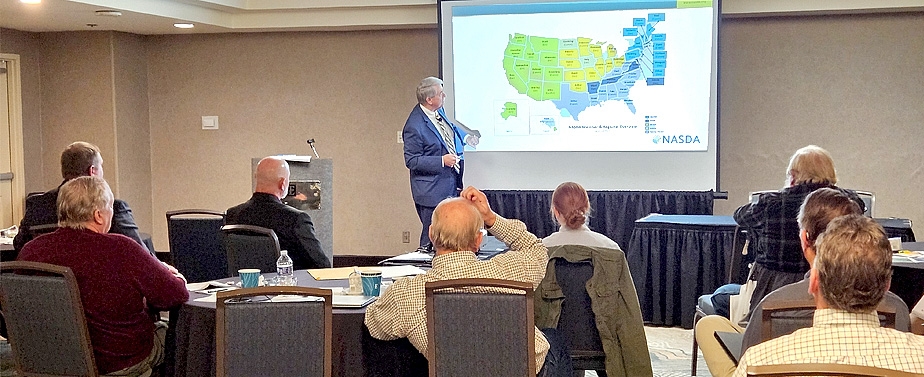

At the 2022 ASAC Conference: Dr. Harold Black on the Economic Outlook

11/17/2022

During the recent ASAC Annual Conference in Oklahoma City, OK, Dr. Harold Black, Professor of Finance, Emeritus at University of Tennessee, provided his thoughts on the current and future status of the US Economy. He opened with a summary of the wide-ranging crises that we face at this unique point in our history. Political divisions, energy prices, the border, crime, the war in Ukraine, Covid, education, inflation, etc. we just some of the current issues we are experiencing.

Dr. Black then listed some of the key economic indicators to watch, such as the Consumer Price Index, the unemployment rate, monthly job openings, Fed Funds rate, Treasury Yields, energy prices, and the value of the US Dollar.

He provided his indicators of a recession. Dr. Black commented, “It’s the new national pastime, looking for the next recession. But spotting a recession is more complicated than playing the ponies. At least there they tell you the post time. But no one will know that the recession is underway until its well underway.”

Then he followed with a list of indicators. The obvious ones are the stock market, where each recession has been preceded by declines in the stock market, but not all declines in the stock market lead to recessions. The next ones are money and markets. His short summary is that since the Fed has pumped a lot of money into the economy which helped create the current levels of inflation, they must raise interest rates to dampen this inflation. He commented that the Fed has reacted too slowly (for political reasons) and now must play catch up. They must also reduce the M2 money supply so that it matches the trend in the growth of the economy. As they reduce the growth in the M2 money supply, it will reduce the growth in the economy, which will lead to a recession.

The final indicator that Dr. Black shared was the negative slope in the Yield Curve. He stated, “In virtually every instance of an unambiguously downward sloping yield curve, there has followed recession. Inversion of some portion of the yield curve has been associated with 13 of the last 17 business cycle peaks since 1910. Thus, there is a message in the yield curve, and that message should be heeded.”

In closing, Dr. Black shared the results of a survey of economists and their predictions for the coming recession, which they agreed will occur. Some of their predictions include: The recession will start in about 12 months (as of October) and last about 8 months, the recession will be mild with only slightly slower growth rates of 0.2% and 0.1% in the in the first two quarters of 2023, unemployment will rise to 4.3%, inflation next year will range from 3% to 5%, the Fed will raise interest rates up to 4.3%, and housing demand will fall.

Dr. Black’s final statement was, “Beware, because when most economists agree, they are often wrong!”

If we missed you at the 2022 ASAC Annual Conference, consider attending next year’s conference. You can find additional information at www.agconsultants.org

Posted by:

Don Tyler

ASAC Member

Tyler & Associates

During the recent ASAC Annual Conference in Oklahoma City, OK, Dr. Harold Black, Professor of Finance, Emeritus at University of Tennessee, provided his thoughts on the current and future status of the US Economy. He opened with a summary of the wide-ranging crises that we face at this unique point in our history. Political divisions, energy prices, the border, crime, the war in Ukraine, Covid, education, inflation, etc. we just some of the current issues we are experiencing.

Dr. Black then listed some of the key economic indicators to watch, such as the Consumer Price Index, the unemployment rate, monthly job openings, Fed Funds rate, Treasury Yields, energy prices, and the value of the US Dollar.

He provided his indicators of a recession. Dr. Black commented, “It’s the new national pastime, looking for the next recession. But spotting a recession is more complicated than playing the ponies. At least there they tell you the post time. But no one will know that the recession is underway until its well underway.”

Then he followed with a list of indicators. The obvious ones are the stock market, where each recession has been preceded by declines in the stock market, but not all declines in the stock market lead to recessions. The next ones are money and markets. His short summary is that since the Fed has pumped a lot of money into the economy which helped create the current levels of inflation, they must raise interest rates to dampen this inflation. He commented that the Fed has reacted too slowly (for political reasons) and now must play catch up. They must also reduce the M2 money supply so that it matches the trend in the growth of the economy. As they reduce the growth in the M2 money supply, it will reduce the growth in the economy, which will lead to a recession.

The final indicator that Dr. Black shared was the negative slope in the Yield Curve. He stated, “In virtually every instance of an unambiguously downward sloping yield curve, there has followed recession. Inversion of some portion of the yield curve has been associated with 13 of the last 17 business cycle peaks since 1910. Thus, there is a message in the yield curve, and that message should be heeded.”

In closing, Dr. Black shared the results of a survey of economists and their predictions for the coming recession, which they agreed will occur. Some of their predictions include: The recession will start in about 12 months (as of October) and last about 8 months, the recession will be mild with only slightly slower growth rates of 0.2% and 0.1% in the in the first two quarters of 2023, unemployment will rise to 4.3%, inflation next year will range from 3% to 5%, the Fed will raise interest rates up to 4.3%, and housing demand will fall.

Dr. Black’s final statement was, “Beware, because when most economists agree, they are often wrong!”

If we missed you at the 2022 ASAC Annual Conference, consider attending next year’s conference. You can find additional information at www.agconsultants.org

Posted by:

Don Tyler

ASAC Member

Tyler & Associates

Post a new comment